In a world where digital transformation is no longer a choice but a necessity, Portuguese banks are stepping up to the challenge. They’re not just dipping their toes into the digital waters; they’re diving in headfirst, and the ripple effects are fascinating. If you’ve ever wondered how traditional banking institutions are keeping pace with tech-savvy fintech firms, then Portugal’s approach will certainly pique your interest.

The Dawn of a New Banking Era

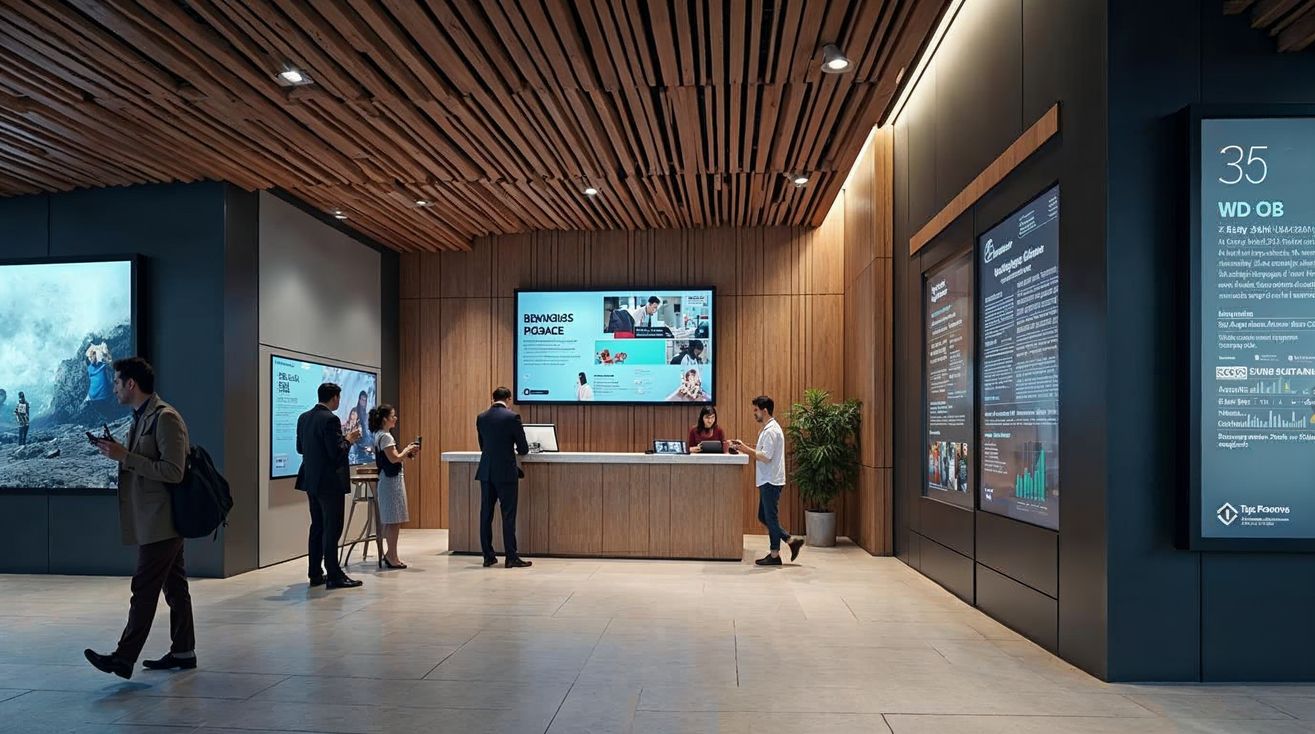

It’s no secret that banks across the globe are embracing digital banking. But in Portugal, this shift feels particularly momentous. For a country that cherishes its rich history and cultural traditions, the move to digital isn’t just about technology—it’s about redefining relationships. Portuguese banks are working hard to offer seamless digital experiences while maintaining the personal touch their customers cherish. It’s a delicate balancing act, and one that requires innovation, empathy, and a touch of finesse.

The Technology Behind the Transformation

At the heart of this transformation lies cutting-edge technology. From mobile apps to AI-driven customer service, Portuguese banks are leveraging tools that were once the domain of tech giants. Banco BPI, for example, has launched a comprehensive digital platform that allows customers to manage their finances with ease. According to a recent report, these platforms are not only enhancing customer satisfaction but are also streamlining operations. It’s a win-win situation, but it doesn’t come without its challenges.

Challenges and Opportunities

While the benefits of digital banking are clear, the road to implementation is not without its bumps. Cybersecurity remains a top concern, as does the need for robust data management. Banks must ensure that their systems are not only efficient but also secure. On the flip side, this digital evolution opens up a world of opportunities. By harnessing data analytics, Portuguese banks can offer personalized financial advice and anticipate customer needs before they even arise. It’s a thrilling prospect, and one that could redefine the banking landscape in Portugal.

The Human Element

In this digital age, it’s easy to forget the human element. But Portuguese banks are keenly aware that technology should serve—not replace—the personal connections they’ve built over decades. Many banks are adopting a hybrid approach, blending digital solutions with human interaction. This strategy ensures that while customers have access to cutting-edge technology, they can still reach out to a real person when needed. It’s a model that respects the past while embracing the future.

Looking Ahead

So, what’s next for Portuguese banks on this digital journey? The landscape is ever-changing, and staying ahead means being adaptable. Banks are already exploring the potential of blockchain technology and open banking, which could unlock unprecedented opportunities for collaboration and innovation. The possibilities are endless, and the excitement is palpable.

As we watch this transformation unfold, one thing is clear: Portuguese banks are not just participants in the digital revolution—they’re leaders. Their commitment to innovation, combined with a deep respect for their cultural heritage, positions them uniquely in the global banking arena. It’s a journey worth watching.

And if you’re in Portugal—or even if you’re not—why not explore what these banks have to offer? You might just find a new way to manage your finances that surprises you. After all, the future of banking is here, and it’s more exciting than ever.