Irs automático 2026: how Portugal reached 85% pre-filled tax returns

Portugal’s tax administration has quietly engineered one of Europe’s most efficient tax systems, and it happened without the fanfare that typically accompanies digital government transformations. The IRS Automático 2026 initiative represents something increasingly rare in public administration: a system that works because it was designed around how people actually behave, not how bureaucrats wish they would.

The numbers tell the story. Portugal has achieved an 85% pre-filled tax return rate, meaning the vast majority of taxpayers simply confirm information that the tax authority already possesses rather than spending hours gathering documents and filling forms. This isn’t accidental efficiency. It’s the result of a deliberate architectural choice to build automated systems that handle complexity behind the scenes, leaving citizens with minimal friction.

What makes this development worth examining now is that other nations are watching. Tax authorities across Europe struggle with outdated systems, compliance burdens that breed resentment, and the persistent gap between what technology could achieve and what actually gets deployed. Portugal’s approach suggests a different path exists, one that treats simplification not as a feature but as a foundational principle.

How Pre-Filled Returns Actually Function

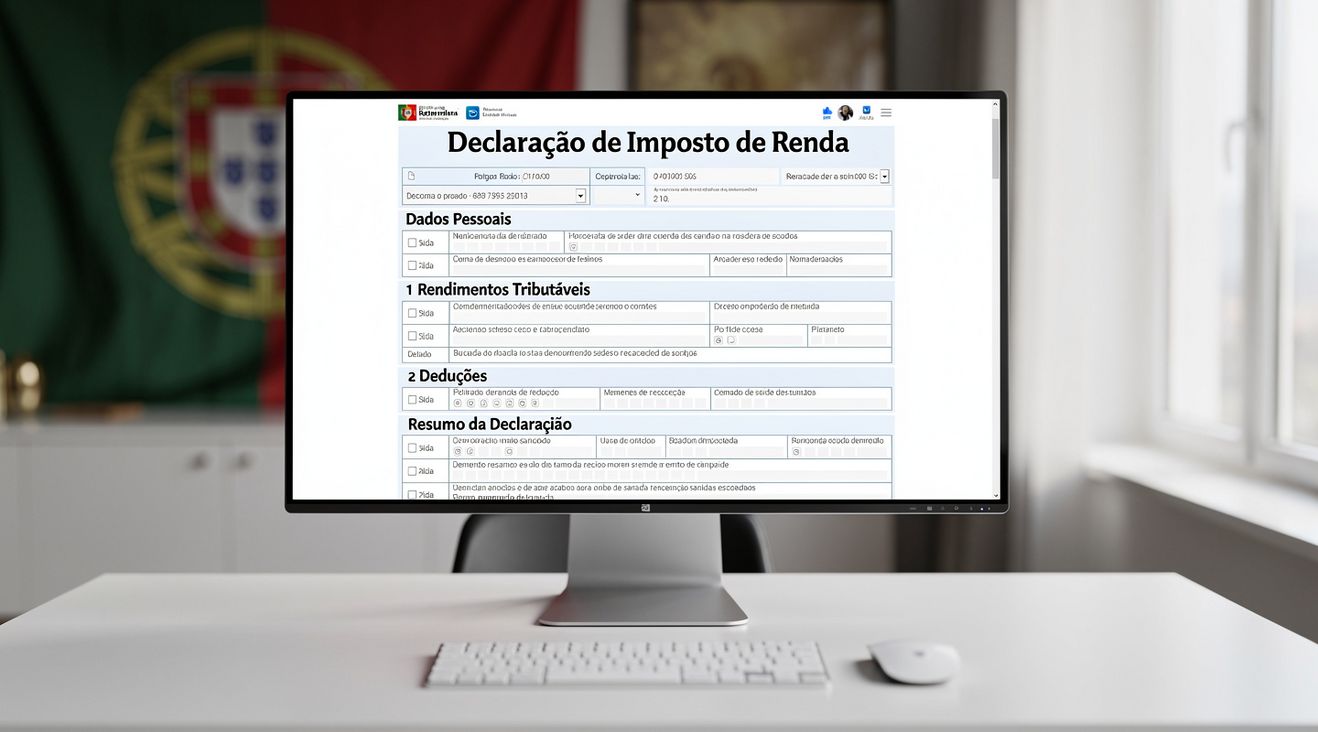

The mechanics are straightforward in concept but complex in execution. Portuguese tax authorities gather information from employers, financial institutions, and other sources throughout the year. Rather than asking citizens to reconstruct this information from memory and paperwork, the system presents citizens with a pre-populated tax declaration that reflects what the government already knows about their income, deductions, and tax obligations.

Citizens can accept this version, make corrections if something is inaccurate, or add information the system doesn’t possess. For straightforward income scenarios, the process takes minutes rather than hours. This represents a fundamental inversion of the traditional tax filing model, where citizens bear the burden of proving their circumstances rather than the state verifying its own records.

The technical infrastructure supporting this required integrated data systems across multiple government and private sector entities. Banks share deposit information. Employers report salary data in real time. Property registries provide asset information. Each integration removed a piece of paperwork from the citizen’s desk.

The Compliance and Trust Dynamics

Something counterintuitive happens when tax filing becomes genuinely simple. Compliance improves not through enforcement but through reduced friction. According to OECD research on tax administration efficiency, countries that minimize filing burdens typically see higher voluntary compliance rates, particularly among middle-income earners who represent the tax base’s largest segment.

Portugal’s experience reflects this pattern. When the system is transparent about what it knows and why it’s making specific calculations, citizens develop different attitudes toward their tax obligations. The adversarial dynamic—where taxpayers assume they’re being hunted and try to obscure information—diminishes. Instead, a collaborative verification process emerges.

“The system works because it respects citizens’ time and treats accuracy as a shared responsibility rather than an enforcement battle” – Tax administration official interviewed about Portugal’s digital transformation

The Infrastructure Requirements Nobody Mentions

Achieving 85% pre-filled returns demands extraordinary inter-institutional coordination. Banks must standardize how they report financial information. Employers need consistent wage reporting protocols. Government agencies must share databases that were historically guarded as separate fiefdoms. This cultural shift often proves more difficult than the technical implementation.

Portugal faced real resistance. Financial institutions worried about data sharing. Privacy advocates questioned whether consolidating tax data created unacceptable surveillance risks. The government addressed these concerns through strict data governance frameworks and transparent rules about what information could be accessed and under what circumstances. The solution wasn’t perfect, yet it balanced efficiency with legitimate privacy concerns.

The infrastructure also requires ongoing investment. System maintenance, security updates, and integration with new data sources demand sustained funding and technical expertise. This is where many ambitious digital government projects founder—initial implementation receives attention, but the unglamorous work of maintaining and improving systems gets underfunded.

What Conventional Tax Policy Discussions Overlook

Most policy debates about taxation focus on rates, deductions, and brackets. Portugal’s achievement suggests that system design and filing experience matter just as much as the tax code itself. A simpler system creates different behavioral incentives than a complex one, independent of what the actual tax rates happen to be.

This has implications beyond compliance. When citizens spend less time navigating tax bureaucracy, they’re not merely saving hours—they’re redirecting mental energy and resources toward other productive activities. The aggregate economic impact of reduced compliance costs is often overlooked in policy analysis, yet it contributes meaningfully to overall productivity.

There’s also a distributional dimension. Complex tax systems disproportionately burden people without resources to hire accountants or tax advisors. Pre-filled returns level this playing field. A retiree with straightforward income faces the same filing experience as a business owner, even if their tax situations differ substantially. This equality of experience, independent of economic status, carries significance that extends beyond administrative efficiency.

The Emerging Questions About Scale and Applicability

Portugal’s success raises legitimate questions about whether this model transfers to larger, more economically diverse nations. The United States tax system involves millions of self-employed individuals, complex investment portfolios, and extensive deduction categories. Could pre-filled returns work in that context?

Theoretically, yes. But the political economy becomes complicated. The tax preparation industry has financial incentives to maintain complexity. Lobbying efforts from companies like Intuit have historically opposed simplified filing systems in the United States. What’s technically feasible isn’t automatically politically achievable.

Portugal’s achievements also depend on relatively high levels of institutional trust and digital infrastructure. Nations with lower trust in government or less developed digital systems face steeper implementation challenges. This doesn’t mean they shouldn’t pursue similar approaches, yet it acknowledges that replicating Portugal’s success requires more than copying technical specifications.

The deeper question emerging from Portugal’s experience is whether we’ve accepted unnecessary complexity as inevitable. Tax systems in many developed nations grew complicated gradually, often for defensible reasons at the time. Yet these historical reasons don’t necessarily justify perpetuating complexity in an era when technology enables alternatives. What gets built as a policy choice can be rebuilt as a different choice, though the political and institutional inertia required to do so shouldn’t be underestimated.